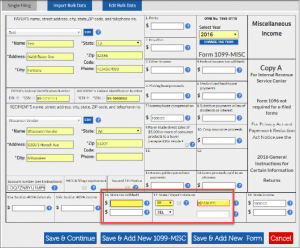

You can also post your own question to the QuickBooks for Mac community. We’ll be updating this page regularly as we continue our progress, so you can check back here or follow us on Twitter ( or Facebook ( ). Details are coming in an email you’ll be soon. We’re making changes in QuickBooks to support these new requirements and help you with this transition. Now the important part: Don’t panic! We’re here for you. For the 2011 tax year, some forms of payments from 1099-MISC will be reported on a new third-party form 1099-K. There you’ll find out more about what these changes mean to you and what you need to do about it.Īs you may have heard, the IRS has new requirements for the 1099-MISC form. We’ve updated our 1099/1096 page with updated information. Subscribe to the support article to be the first on your block to know that the fix is out, and check back here for details. We’re working on getting you a fix ASAP, and we’ll let you know as soon as we’ve got an update you can download. Now when you print your 1096 form, there’s a X that’s not in the right place which will make the IRS unhappy. Uh oh! On top of all the other tax changes for 2011, the IRS has changed the physical 1096 form. On the Accounts section, place a checkmark on.

Select Continue your 1099s or Let’s get started. Go to the Expenses menu and then select Vendors. In QuickBooks Online, you have an option to select an account when preparing for 1099. (QuickBooks > Check for QuickBooks Updates) I'm here to ensure you're able to prepare your 1099, 5955JJBL.

If you’re using QuickBooks 2010 or 2011 and looking for the app you received email about several weeks ago, that app is no longer available. Go to our 1099/1096 page for instructions on what you need to do. The IRS has new regulations for filing 1099s.

0 kommentar(er)

0 kommentar(er)